TrustSwap provides DeFi tools for token holders & businesses to buy, trade, create, and secure crypto assets with confidence.

$0B

Peak Locked Value

0

Projects Using TrustSwap

World Class Crypto App Bespoke NFT Solutions Industry Leading Launchpad Competitive Farming Pools Pre-Audited Token Generator Enterprise Escrow Solutions

Swappable

White-glove turnkey solutions to bring your project to life in the Web3 world through the power of NFTs.

For Token Holders

Early access to DeFi startups, stake SWAP to earn rewards, and transact with confidence using our Escrow services.

For Business

Create pre-audited tokens for free. Lock liquidity and vest tokens to boost your credibility with investors.

The Crypto App

Track your favourite crypto and stay on top of the latest trends with The Crypto App powered by TrustSwap.

Never miss an update, sign up now.

Track your favourite crypto and stay on top of the latest trends

4+ Million Downloads

Tracker

Build custom lists, monitor over 6000 coins from 100+ exchanges

Alerts

Get an edge on the market by setting alerts for instant push notifications

Widget

Instant widgets on your home screen for your own personalized market summary

News

Personalized newsfeed with content from the most trusted brands in crypto media

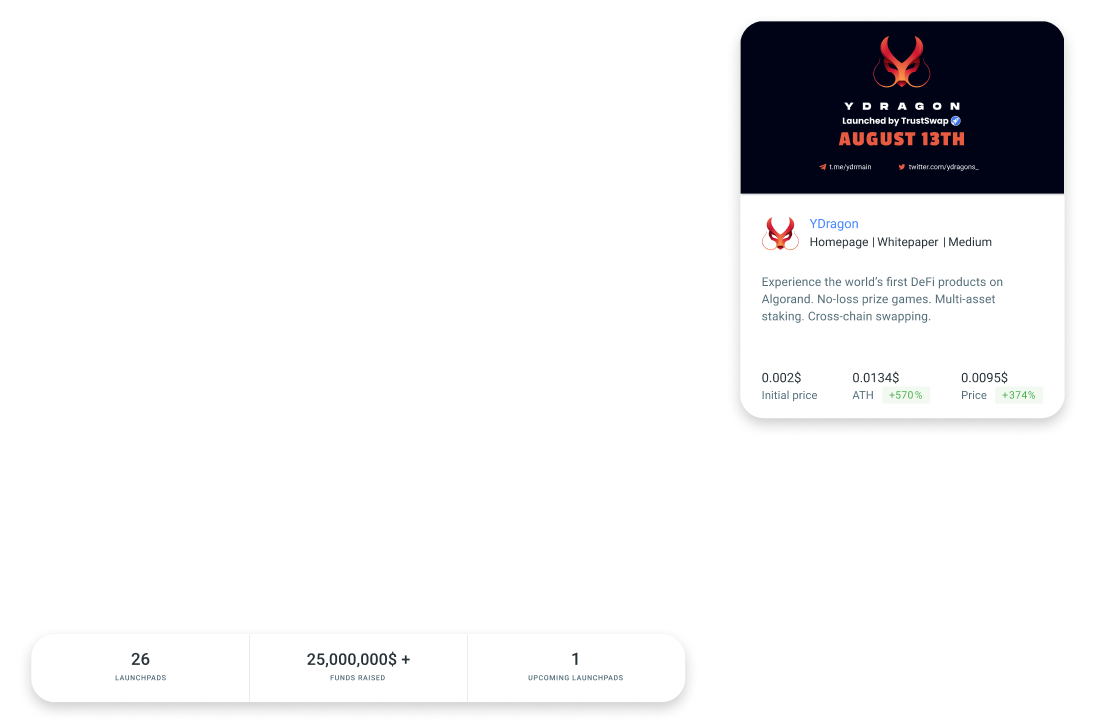

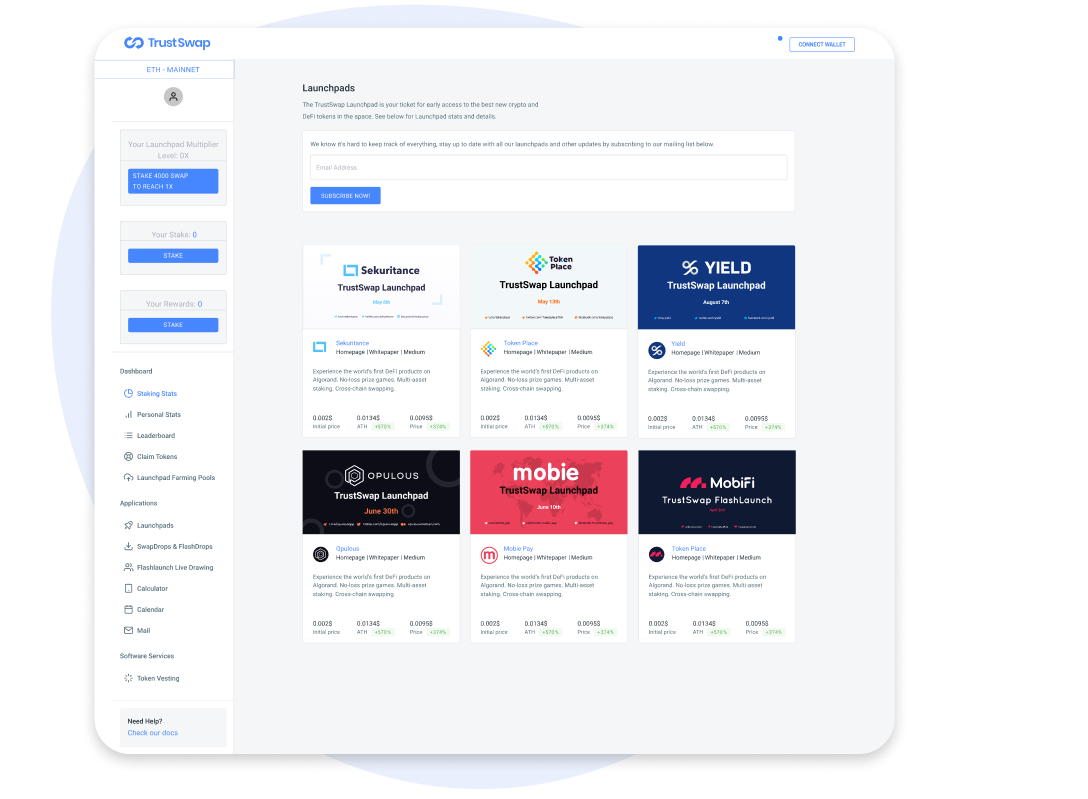

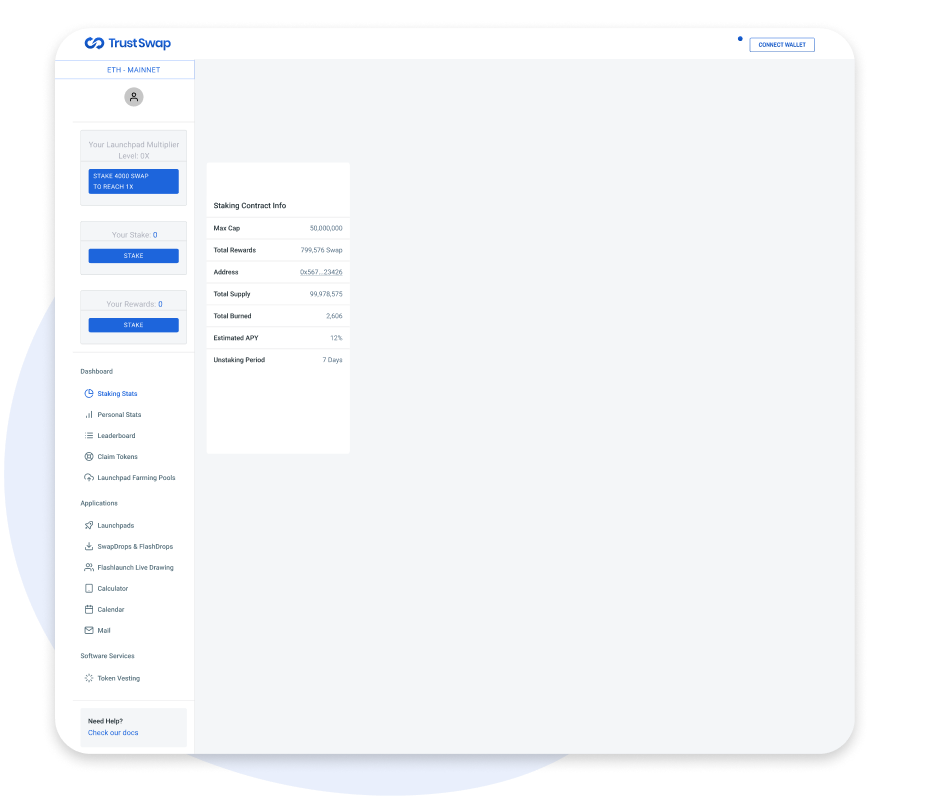

Launchpads

Crypto enthusiasts – get early access to some of the most promising crypto and DeFi projects. If you have a crypto business, launch your project into the world with TrustSwap.

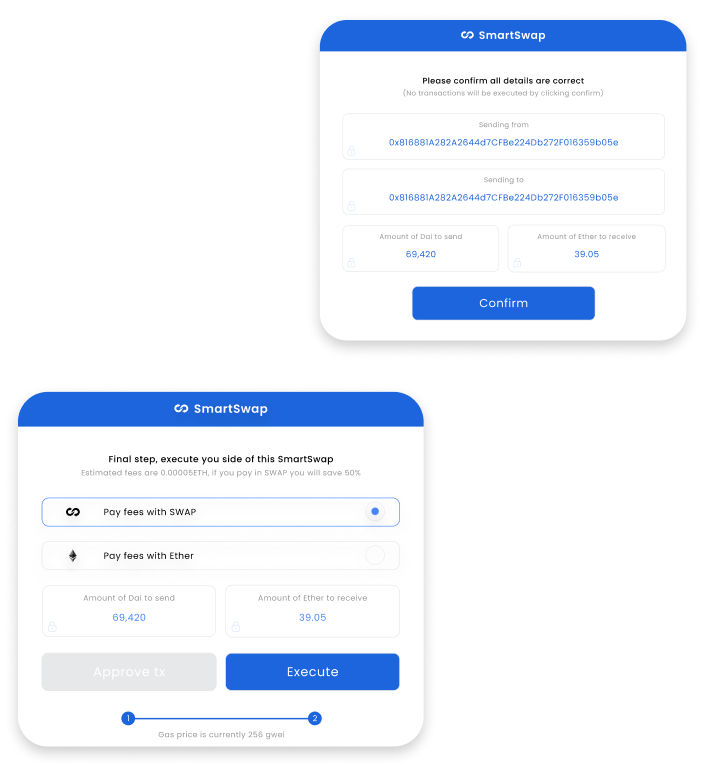

Token Swaps & Escrow

Swap any ERC-20 token with any person in the world. Say Goodbye to sky high escrow fees.

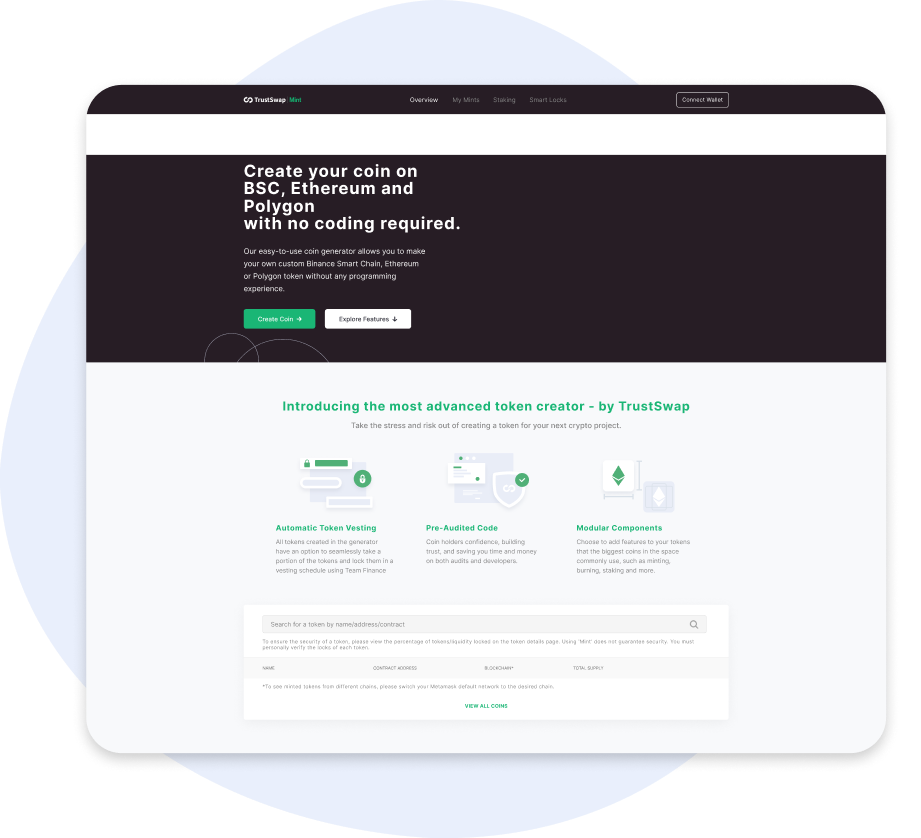

Create pre-audited tokens for free. Lock liquidity and vest tokens to boost your credibility to investors

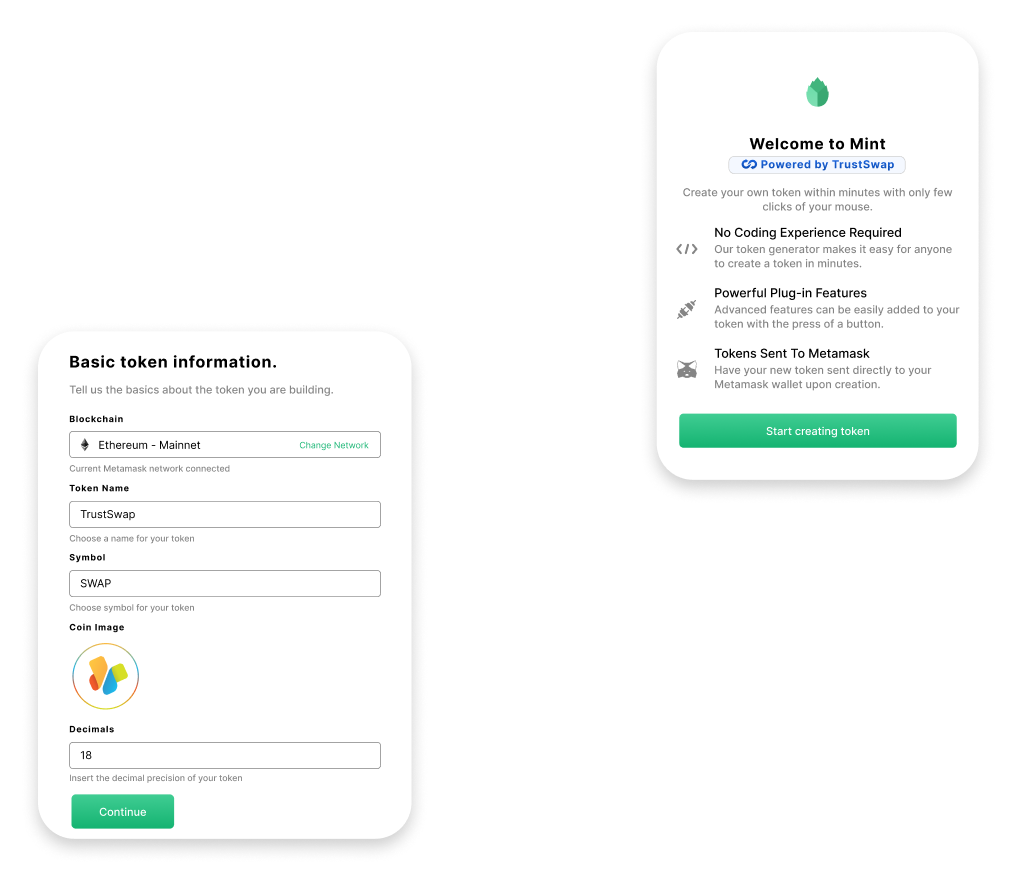

Mint

Use our Mint to easily create and customize your own cryptocurrencies, for free, without having to pay thousands of dollars for code audit and development.

Mint

Use our Mint to easily create and customize your own cryptocurrencies, for free, without having to pay thousands of dollars for code audit and development.

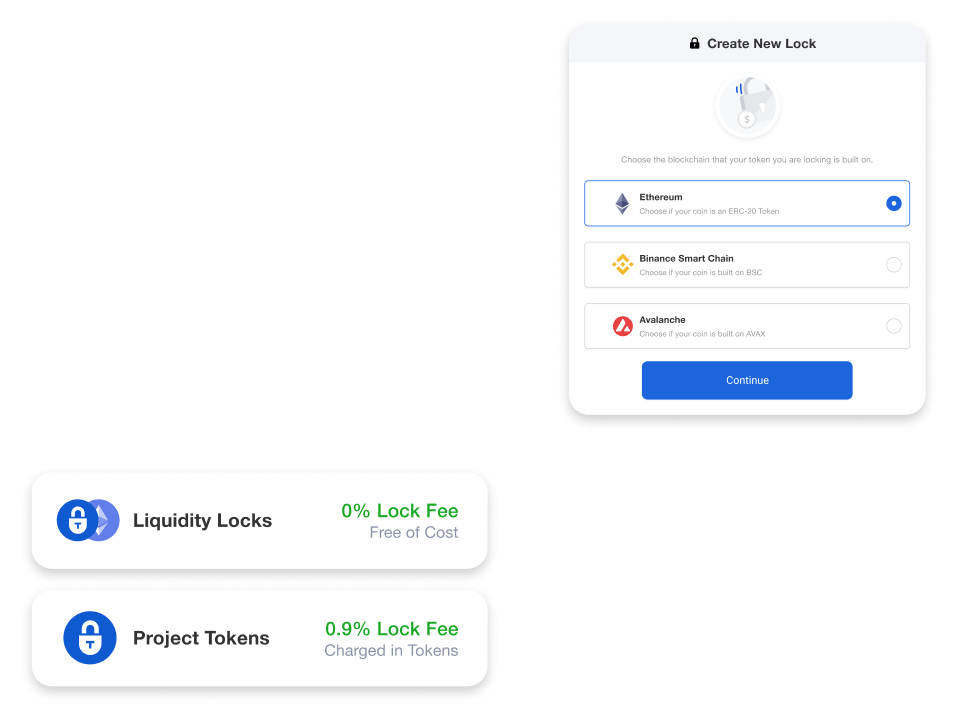

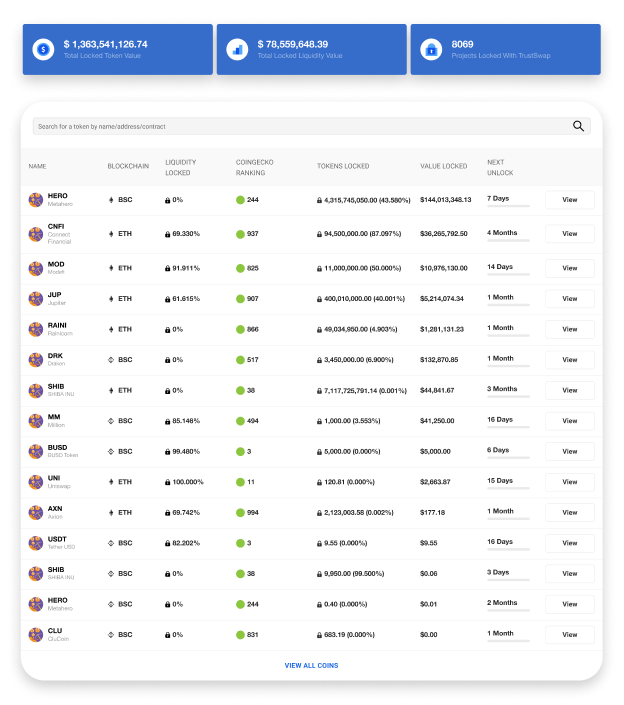

Token Lock

Use Token Lock, set customized release schedules for teams and token holders.

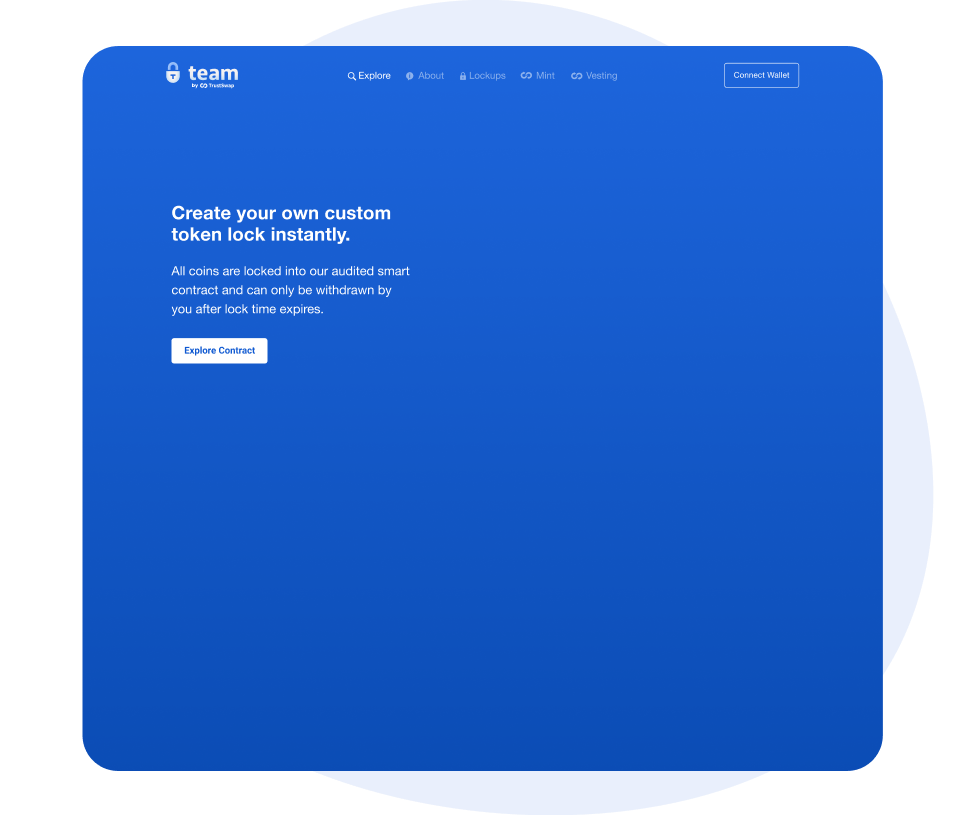

Liquidity Lock

Use Team Finance to enhance your company’s credibility. Projects can lock their liquidity pool tokens into a trustless vault that returns tokens after specified timeframes.

Liquidity Lock

Use Team Finance to enhance your company’s credibility. Projects can lock their liquidity pool tokens into a trustless vault that returns tokens after specified timeframes.

1 Million trees planted in partnership with Eden Reforestation. These trees are tended to until full maturity, helping employment in developing nations.

Successful TrustSwap and Swappable collaborations with UNICEF launching NFT auctions and all proceeds going directly to children in need.

Supporting KlimaDAO, to date, we have removed 250 Tons of Carbon Credits from the market, effectively making pollution more expensive.